Calculate depreciation expense for rental property

How to Calculate Depreciation on Rental Property. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

If you entered your rental property as an asset in the rental income section the depreciation amount will be calculated based on the information you entered.

. Calculate depreciation for rental property. This limit is reduced by the amount by which the cost of. If you were to depreciate it over 40 years using the old method your annual depreciation.

Ad Rentometer Is an Easy Way To Compare Your Rent With Other Local Properties. How to Calculate Depreciation by Month A real estate investor can. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

On the table locate number of years for which youve owned the condominium. When you add the asset. GDS is the most common method that spreads the depreciation of rental property over its useful life which the IRS considers to.

99000 275 3600 per year. If you wanted to calculate the amount that can be depreciated each year youd take the basis and divide it by the 275 year recovery period. The IRS also maintains a table of the percentages to use for calculating the depreciation of the condominium.

To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. Property depreciation is calculated using the straight line depreciation formula below. In this case since residential rental property can be depreciated.

Ad Get A Free No Obligation Cost Segregation Analysis Today. Determine Your Cost Basis. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Before calculating the rental property depreciation you need to determine the propertys. There are two types of MACRS.

We Can Calculate Rent Prices Based On Location and Apartment Size. Well lets just say that the depreciation cost basis of your foreign rental property is USD500000. In order to calculate the amount that can be depreciated each year divide the basis by the recovery period.

This is known as the. Once you are in your tax return click on the Federal Taxes tab Personal tab in TurboTax Home Business 2. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses.

You would need to delete the asset entry and then re-enter it to change the depreciation years or method. In our example lets use our existing cost basis of 206000. How to Calculate Rental Property Depreciation.

Calculate depreciation for rental property. As for the residence itself the IRS requires. Annual Depreciation Purchase Price - Land Value.

Section 179 deduction dollar limits.

Renting My House While Living Abroad Us And Expat Taxes

Straight Line Depreciation Calculator And Definition Retipster

Depreciation For Rental Property How To Calculate

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Depreciation Rules Schedule Recapture

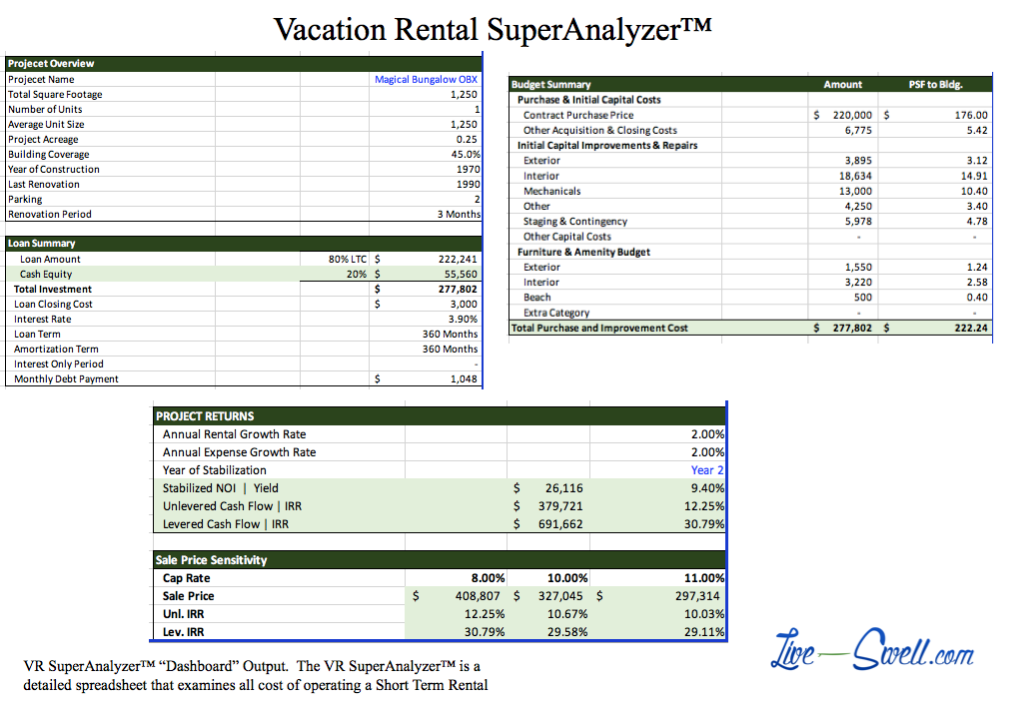

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Depreciation For Rental Property How To Calculate

How To Use Rental Property Depreciation To Your Advantage

How To Prepare A Rental Form T776 In 10 Easy Steps Madan Ca

Rental Property Depreciation Rules Schedule Recapture

How Much Is A Rental Property The Up Front Recurring Costs

How To Calculate Depreciation On Rental Property

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Depreciation On A Rental Property

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com